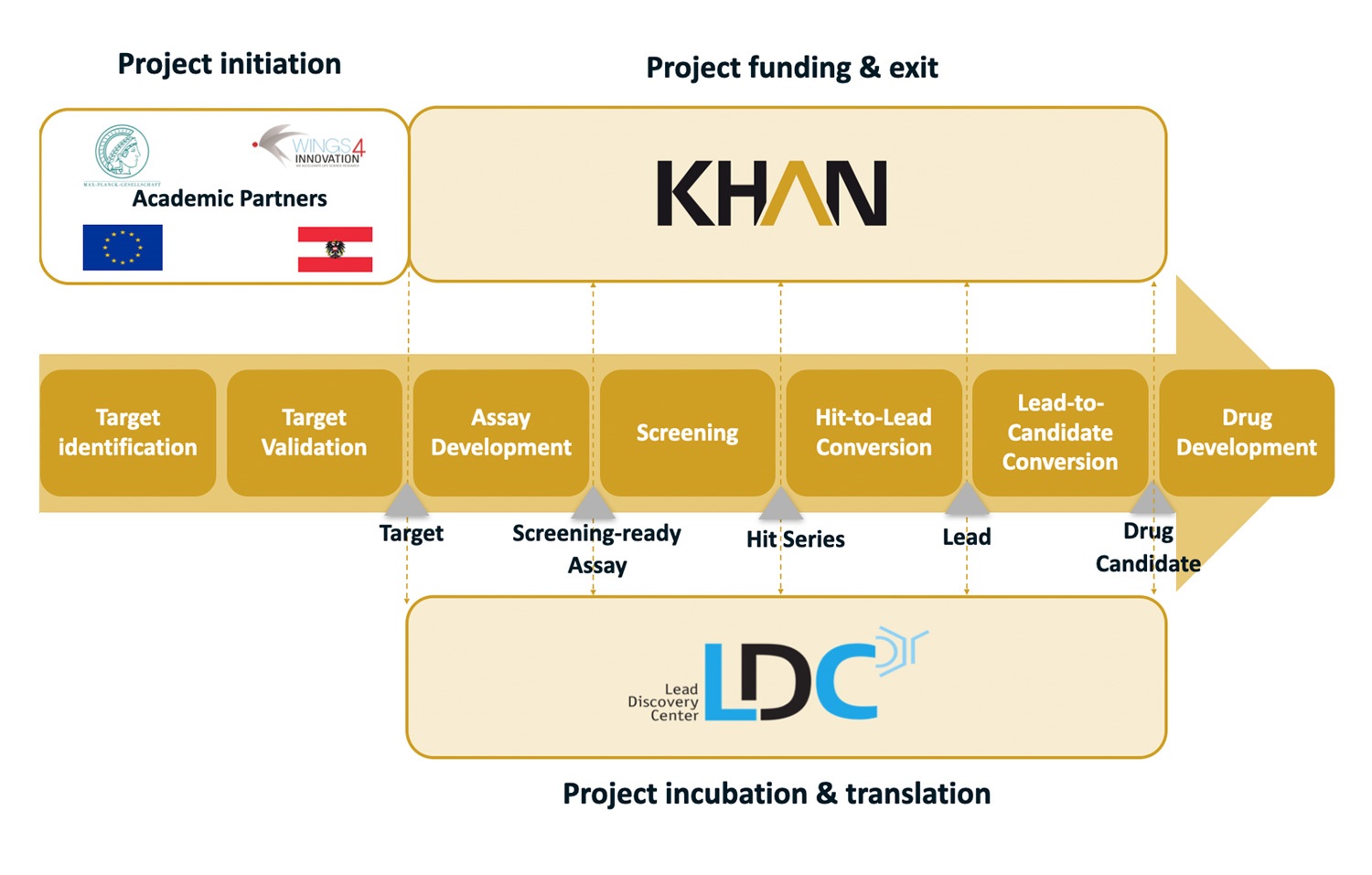

In order to close the gap in translating science into products and to help scientific discoveries to unfold their full potential, KHAN operates in close partnership with the Lead Discovery Center GmbH (LDC) in Dortmund and Munich. The LDC is a fully operational drug discovery incubator with an established broad academic and industrial network. It provides state-of-the art drug discovery services in accordance with industry standards. KHAN owns all IP rights of KHAN-financed projects.

KHAN benefits from an investment of the European Investment Fund (EIF), with funding provided by InnovFin Equity, with the financial backing of the European Union under Horizon 2020 Financial Instruments and the European Partnership for Strategic Investments (EFSI) set up under the Investment Plan for Europe. The purpose of EFSI is to help support financing and implementing productive investments in the European Union and to ensure increased access to financing.

The Max Planck Foundation is an independent, non-profit organization of private supporters of top research in the Max Planck Society.

Austria Wirtschaftsservice Gesellschaft mbH (aws) is the promotional bank of the Austrian government. aws funds for KHAN are provided by the Austrian Federal Ministry of Labour and Economy and the Austrian National Foundation for Research, Technology and Development (NFTE).

Akros Pharma Inc. is a wholly owned subsidiary of JT America, which is, in turn, a wholly owned subsidiary of Japan Tobacco Inc., headquartered in Tokyo, Japan. Akros Pharma Inc. is recognized in the pharmaceutical industry for its innovative drug discovery and development. The company is committed to developing new pharmaceutical products for the U.S. and global markets.

Thyssen’sche Handelsgesellschaft (THG) is a German single-family office with roots in the Julius Thyssen family. THG follows a long-term investment approach and owns a highly diversified set of portfolio companies in different industry segments.

The Max Planck Society (MPG) and KHAN have set-up a strategic partnership agreement to jointly invest into the translation of promising early-stage academic projects in the field of drug discovery originating from Max Planck Institutes.

Both MPG and KHAN have the right to jointly co-fund such MPG projects on a 50:50 basis.